marketing@goldstarinsurance.com

Drop us a line

+256 41 4250110

Make a call

X

Drop us a line

Make a call

Goldstar is one of the leading Insurance Companies in Uganda. We provide all types of General Insurance services to industrial, commercial, professional firms, Government institutions, individuals and other enterprises throughout Uganda.

Find Us

Make a call

Drop us a line

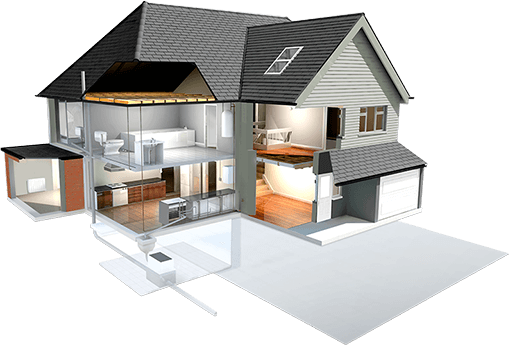

Renters Insurance from Goldstar is comprehensive cover to protect your residential premises against various risks when you are renting your home. Your home, as well as everything inside of it, is protected with Goldstar.

If you are renting out a property then you’ll need to have Home Insurance. Protecting your home and assets is vital to ensure all your hard work is not lost in the event of the unexpected.

Check your rental agreement as you may be required to take insurance for the building as well. If your landlord is responsible for the building, you can still purchase a tailored plan from Goldstar to cover your personal belongings.

Loss or damage to buildings

Loss or damage to your contents

New for old replacements

Personal money

Cover for domestic employees

Public Liability

Unfortunately, we can’t cover everything – make sure you’re happy with what’s not covered, including:

Home Insurance (Domestic Package) from Goldstar is comprehensive cover to protect your residential premises against various risks. Your home, as well as everything inside of it…

We offer a range of options on Comprehensive Private Motor Cycle insurance so you can customize it to your individual needs.

Car insurance protects your vehicle from unforeseen risks and provides protection against the losses incurred.

You will need contents insurance, sometimes known as all risk cover, for items for which you require cover out with the home. Please provide details of these items at the time of quotation to ensure that the policy provided meets with your requirements.

Accidental Damage cover provides protection against costs incurred through damage that you, your family members or visitors may cause to the structure of your Building or to your Contents. Examples of incidents which would be covered under this extension include putting your foot through the loft floor damaging the ceiling below, leaving a tap running leading to water damage or carpet spillages. Such incidents would not be included under a policy taken out to cover Standard Perils only.

Additional charges will apply and in certain circumstances this cover might not be available.

Items kept in the garage or garden sheds will be covered under the Contents section of your policy provided you have included their value in the total sum insured declared. Limits may apply to the amount that can be claimed for theft of items taken from outbuildings and additional charges may be made for certain items such as ride on mowers. Cover for motor vehicles and motorcycles is excluded. Please declare your requirements for cover kept in outbuildings at the time of quotation to ensure that the policy provided meets with your requirements.

In most cases you will need to arrange cover for your own contents and personal possessions. Please refer to your tenancy agreement to check what, if any cover is provided by your landlord.

An excess is the amount a policyholder is required to pay towards the cost of any claim. You may be asked to pay this amount to a company that has carried out repairs on behalf of your insurer, or alternatively the sum will be deducted from any settlement received.

No matter what your worry is, we’re here to help explain the process, assess your claim fairly and minimize the disruption to you with a transparent claims process.

Read More...We have a number of options to help you make a claim quickly and effectively. Contact our dedicated claims team for advice on an incident/claim.

Read More...Goldstar Insurance was IFM’s Best Insurance Company in Uganda (2015) and has over the years consistently maintained a Global A+ Credit Rating

Read More...Have any Question? Ask us anything, we’d love to answer!